Published on December 16, 2025

The broader crypto market remains under intense pressure today as risk assets sell off globally. Ethereum (ETH) has been one of the hardest-hit major assets, with prices falling sharply while both institutional ETF flows and on-chain whale positioning flash bearish signals.

Publicly available ETF data shows three consecutive days of Ethereum ETF outflows, while internal whale analytics reveal aggressive short positioning by large players. This alignment between traditional institutional flows and leveraged whale behavior often precedes heightened volatility.

In this report, we break down Ethereum ETF flows, whale positioning, technical indicators, and what this combined data suggests for ETH price action next.

This analysis is based on publicly available ETF data and internal whale/indicator tracking and does not constitute financial advice.

Impact of Ethereum ETF Outflows on Market Sentiment

According to publicly available data tracked by CoinMarketCap, Ethereum ETFs recorded a net outflow of approximately $224.8 million on December 15, extending a multi-day trend of capital exiting ETH-linked investment products.

Key Ethereum ETF Flow Highlights:

- Daily net flow (Dec 15): –$224.8M

- Last week: Net inflows (+$35.5M)

- Last month: Net outflows (–$177.9M)

- Last 3 months: Net outflows (–$61.7M)

Sustained ETF outflows typically reflect reduced institutional risk appetite, especially during periods of macro uncertainty and broader crypto market weakness.

While ETF flows alone do not determine short-term price direction, they provide important context when combined with on-chain and derivatives data.

Whale Positioning Confirms Bearish Bias

Ethereum whale data shows a clear bearish tilt, aligning closely with ETF outflows.

Ethereum Whale Overview (24H / 7D)

- Whale Bias: Bearish

- Long Positions: 12.5%

- Short Positions: 87.5%

- Total Whale Volume: $908.3M

- Net Whale Position: Short Heavy

- Average Entry: $3,179.81

- Average PnL: 129.57%

Whales have committed over $676M in short exposure, compared to just $231M in long positions, indicating strong conviction that downside risk remains elevated.

When ETF outflows and whale shorts align, it often signals institutional and smart money consensus rather than isolated speculation.

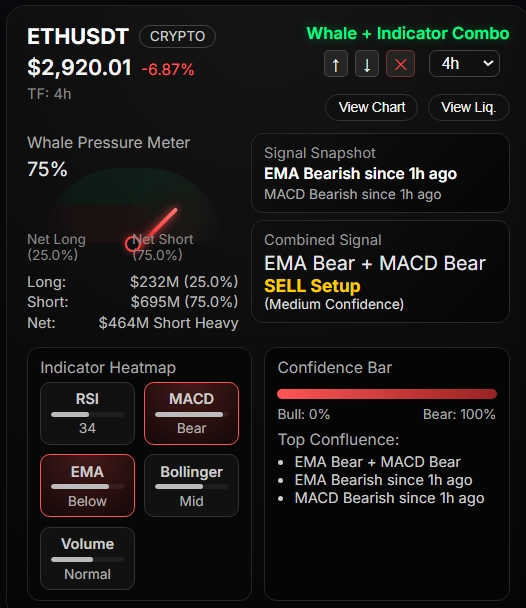

Technical Indicators: Trend Still Under Pressure

From a multi-timeframe technical perspective, Ethereum remains technically weak.

ETHUSDT (4H) Indicator Snapshot

- Price: $2,929.22 (–6.53%)

- EMA: Below key averages (Bearish)

- MACD: Bearish momentum

- RSI: 34 (approaching oversold)

- Bollinger Bands: Mid-range, no confirmed reversal

- Combined Signal: EMA Bear + MACD Bear

- Confidence: Medium (Bearish)

Despite RSI nearing oversold territory, momentum indicators suggest that trend pressure has not yet fully reset, leaving room for further volatility.

Why ETF Flows and Whale Data Matter Together

ETF flows represent regulated institutional positioning, while whale data reflects leveraged and on-chain behavior. When both move in the same direction, the signal is significantly stronger.

Current Alignment:

- ETF Flows: Persistent outflows

- Whales: Aggressive short exposure

- Indicators: Bearish trend confirmation

This combination historically favors:

- Continued downside volatility

- Short-term relief bounces being sold into

- Higher probability of consolidation before a sustainable reversal

What Could Change the Outlook for ETH?

While the near-term picture remains bearish, several conditions could shift sentiment:

- ETF Flow Stabilization

- A slowdown or reversal in ETF outflows would signal renewed institutional interest.

- Whale Short Covering

- Rapid reduction in short exposure could trigger sharp relief rallies.

- Technical Reversal Signals

- Bullish MACD crossover or EMA reclaim on higher timeframes.

Until at least one of these factors emerges, caution remains warranted.

Short-Term ETH Outlook

Ethereum is currently trading in a high-risk, high-volatility environment. Oversold conditions may attract speculative interest, but trend confirmation remains bearish as long as ETF outflows and whale short dominance persist.

Traders and investors should closely monitor:

- Daily ETF flow updates

- Changes in whale net positioning

- Indicator shifts on the 4H and daily charts

Final Thoughts

The current Ethereum sell-off is not driven by retail panic alone. Institutional ETF outflows and whale positioning both point to continued caution, suggesting that downside risks remain until clear evidence of accumulation emerges.

Patience and disciplined risk management are essential as Ethereum navigates this phase of the crypto market cycle.

Disclaimer

This content is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile.

For live Ethereum price, ETF flows, and market data, visit:

Ethereum ETF data on CoinMarketCapFor more whale-driven crypto insights and market analysis, explore:

Crypto News Page — Whale & Institutional Analysis