The crypto market continues to show mixed signals as short-term selling pressure clashes with improving higher-timeframe structures. Ethereum, XRP, and Cardano are all trading lower on the session, but their internal dynamics differ sharply when whale positioning and indicator behavior are compared across timeframes.

This divergence highlights a market that is stabilizing after recent volatility, yet remains structurally fragile.

Ethereum (ETHUSDT) Technical Analysis

ETH 4H Structure: Early Stabilization Signals

On the 4-hour timeframe, Ethereum is showing early technical improvement:

- Price: ~$2,973

- EMA: Above

- MACD: Bullish crossover (recent)

- RSI: 51 (neutral)

- Bollinger Bands: Mid

- Volume: Normal

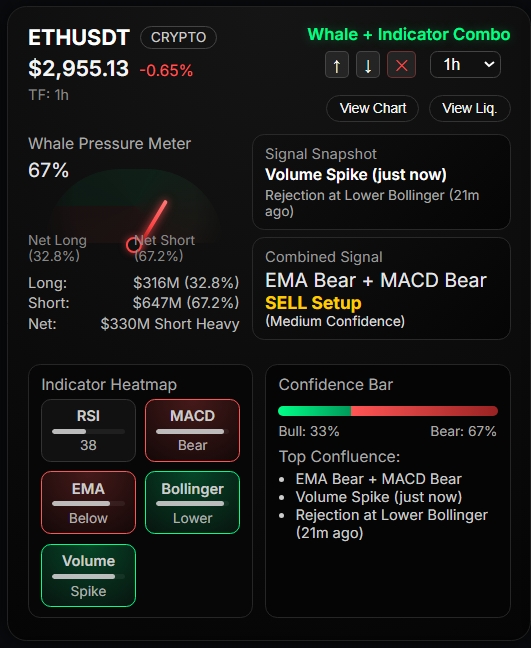

Despite these improving indicators, whale positioning remains decisively bearish:

- Whale Short Exposure: 67.2%

- Net Whale Pressure: $330M short-heavy

This suggests that while momentum indicators are turning positive, larger participants are not yet positioning for sustained upside.

ETH 1H Structure: Short-Term Rejection

The 1-hour timeframe paints a very different picture:

- EMA: Below

- MACD: Bearish

- RSI: 45

- Volume: Spike (selling activity)

- Combined Signal: SELL (Medium Confidence)

The volume spike combined with bearish EMA and MACD confirms short-term distribution, likely driven by traders selling into minor rebounds.

Key ETH Insight:

Ethereum is caught between short-term selling pressure and higher-timeframe stabilization, with whale shorts acting as a structural ceiling.

Traders tracking broader market sentiment should also watch how Bitcoin and XRP are reacting to similar whale pressure, as capital rotation between majors often signals the next directional move.

👉 Read full breakdown: Bitcoin, Ethereum & XRP Whale + Technical Analysis

XRP (XRPUSDT) Technical Analysis

XRP 4H Structure: Relative Strength

XRP continues to show relative strength compared to ETH and ADA on higher timeframes:

- EMA: Above

- MACD: Bullish

- RSI: 50

- Bollinger Bands: Mid

- Whale Positioning: 75.1% long-heavy

- Net Whale Position: $62M long

This indicates that whales are maintaining exposure rather than aggressively hedging downside.

XRP 1H Structure: Short-Term Pullback

Short-term momentum, however, has weakened:

- EMA: Below

- MACD: Bearish

- RSI: 44

- Bollinger Bands: Lower

- Volume: Spike

- Combined Signal: SELL (Medium Confidence)

The rejection near the upper Bollinger Band followed by increased volume suggests profit-taking, not structural breakdown.

Key XRP Insight:

XRP shows the strongest higher-timeframe support among the three assets, but short-term volatility remains elevated.

Cardano (ADAUSDT) Technical Analysis

ADA 1H Structure: Active Sell Pressure

Cardano is currently the weakest performer on lower timeframes:

- Price: ~$0.36

- EMA: Below

- MACD: Bearish

- RSI: 32 (near oversold)

- Bollinger Bands: Lower

- Volume: Spike

- Combined Signal: SELL (Medium Confidence)

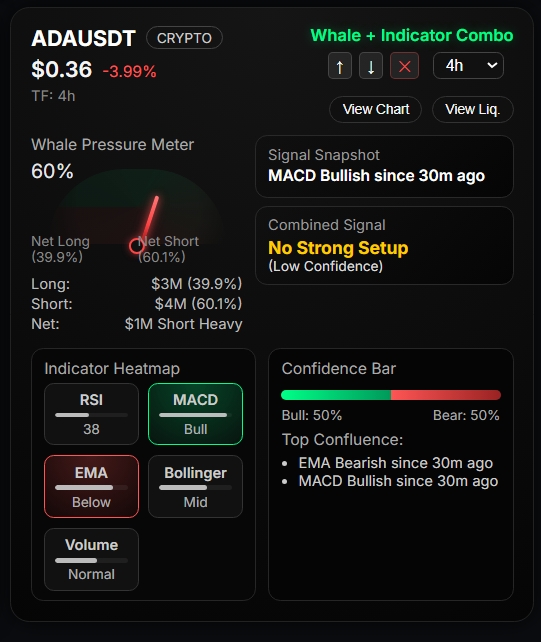

Whale positioning remains short-heavy (60.1%), reinforcing downside pressure during high-volume moves.

ADA 4H Structure: Indecision Phase

On the 4-hour chart, Cardano shows no clear directional conviction:

- EMA: Below

- MACD: Bullish (recent flip)

- RSI: 39

- Bollinger Bands: Mid

- Combined Signal: No Strong Setup

This reflects a market still searching for balance after aggressive selling.

Key ADA Insight:

Cardano remains vulnerable, with weak structure and limited confirmation of stabilization.

Cross-Asset Comparison: What the Data Shows

| Asset | 1H Bias | 4H Bias | Whale Positioning | Structural Risk |

|---|---|---|---|---|

| Ethereum | Bearish | Improving | Short-heavy | ETF + whale pressure |

| XRP | Bearish | Bullish | Long-heavy | Short-term volatility |

| Cardano | Bearish | Neutral | Short-heavy | Weak structure |

Market-Wide Takeaway

Across Ethereum, XRP, and Cardano, the data reveals a consistent theme:

- Short-term timeframes show active selling and rejection

- Higher timeframes show early stabilization attempts

- Whale positioning remains the dominant risk factor

This is not a breakout environment — it is a transition phase, where price may move sharply in either direction depending on whether whale pressure eases or intensifies.

Related Market Analysis

- 📊 Bitcoin whale pressure remains elevated despite bullish EMA signals → Read analysis

According to publicly available ETF flow data, Ethereum has seen consistent net outflows over the past week, reflecting continued institutional caution.

Source:

- Ethereum ETF Flow Data – https://coinmarketcap.com/etf/ethereum/

- Crypto Market Overview – https://coinmarketcap.com/

Disclaimer

This analysis is based on market data and technical indicators only and does not constitute financial advice.