Introduction: Where Is Smart Money Moving?

This Bitcoin, Ethereum, and XRP price analysis reveals what Smart Money (whales) is doing today using real on-chain and technical confluence signals. This is crucial for our Bitcoin Ethereum XRP Analysis.

Bitcoin Ethereum XRP Analysis Overview

“What are whales doing right now—and what does technical analysis confirm?”

Market news creates noise. Our analysis cuts through it using:

- Whale Pressure Meter

- Technical Indicator Heatmap

- Combined Signal Engine

- Our Bitcoin Ethereum XRP price analysis uses a unique blend of whale metrics and indicator heatmaps to identify high-confidence setups.

Let’s break down today’s most actionable signals for the top trending coins.

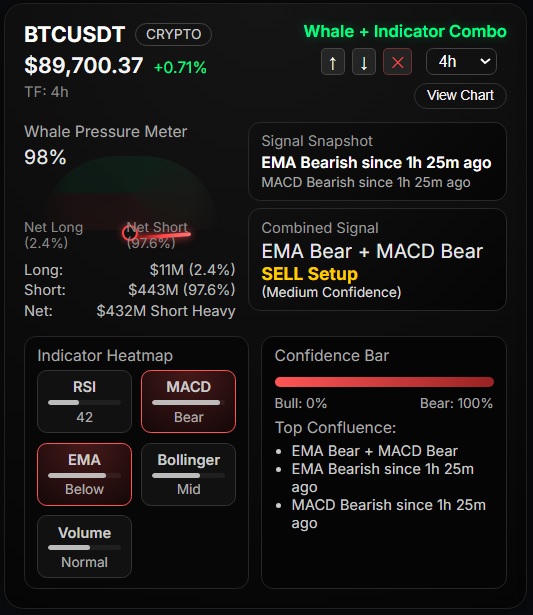

🥇 1. Bitcoin (BTC) Analysis — Extreme Bearish Whale Positioning

📌 Current Price: (auto fill from dashboard)

📌 Timeframe: 4H analysis

📸 Screenshot: BTC Whale + Indicator Dashboard

BTC Key Data

| Data Point | Value | Interpretation |

| Whale Pressure Meter | 98% Net Short | EXTREME Bearish |

| Short Notional Value | $432M Short | Heavy sell pressure |

| Combined Signal | SELL Setup | Medium Confidence |

| Top Confluence | EMA Bearish + MACD Bearish | Strong aligned indicators |

BTC Conclusion

Bitcoin’s whale map is signaling an aggressive short setup.

Until the Whale Pressure Meter flips back toward Net Long, any bullish move is likely a trap.

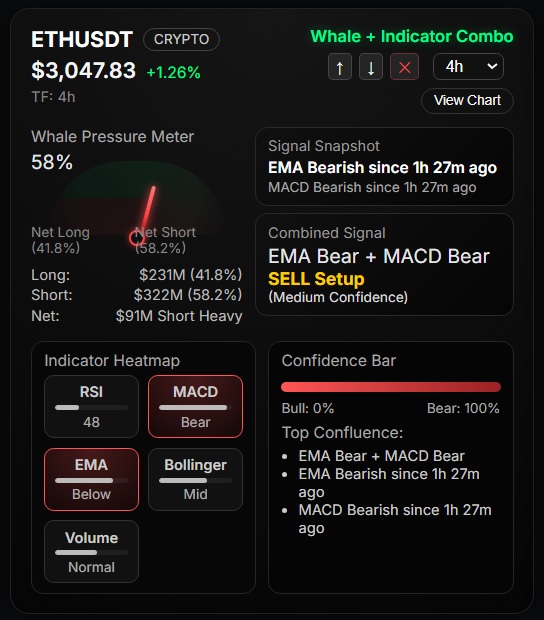

🥈 2. Ethereum (ETH) Analysis — Bearish Momentum with Weak Indicators

📌 Current Price:(auto fill)

📌 Timeframe:4H

📸 Screenshot: ETH Whale + Indicator Dashboard

ETH Key Data

| Data Point | Value | Interpretation |

| Whale Pressure Meter | 59% Net Short | Moderately bearish |

| Hyperliquid Bias | 76.7% Short | Derivatives strongly bearish |

| Combined Signal | SELL Setup | Medium Confidence |

| Indicator Heatmap | RSI 48, MACD Bear | Weak momentum |

ETH Conclusion

Ethereum is facing a wall of short pressure, both on-chain and in derivatives.

No bullish reversal is likely until short positions unwind meaningfully.

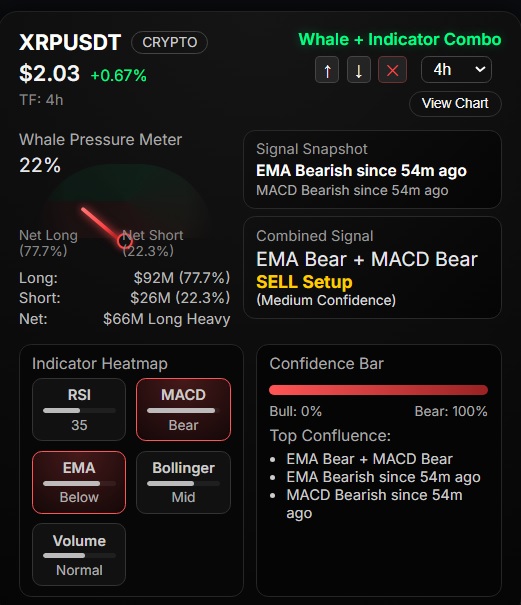

🥉 3. XRP Analysis — Highest Short Dominance Among Trending Assets

📌 Current Price: (auto fill)

📌 Timeframe: 4H

📸 Screenshot: XRP Whale + Indicator Dashboard

XRP Key Data

| Data Point | Value | Interpretation |

| Whale Pressure Meter | 78% Net Short | Highly bearish |

| Short Notional Value | $69M+ Short | Whales suppressing upside |

| Combined Signal | SELL Setup | Clear bearish |

| Hyperliquid Bias | 78.9% Short | Strongest short dominance |

XRP Conclusion

XRP’s upward momentum is being aggressively capped by whales.

Current volatility is being exploited for short positions—bullish moves are unlikely to sustain.

✅ Summary: Final Action Plan

Across BTC, ETH, and XRP, Whale Pressure and Technical Indicators are unanimously showing:

The market is currently under strong bearish control.

Short-term traders should track the 4H and 1D trend structure closely. A bullish reversal will only be

confirmed when we see a synchronized shift in Whale Pressure Meter, RSI momentum, and MACD

crossover across all three assets. Until then, the market remains vulnerable to sharp downside moves

triggered by aggressive Whale positioning.

the underlying indicators show that institutional traders are still cautious. On-chain liquidity pockets for BTC, ETH, and XRP continue shifting downward, which indicates that large players expect better re-entry prices before committing fresh capital.

Actionable Insights:

✔ Avoid opening new long positions

✔ Wait for clear Net Long Whale shift

✔ Confirm technical signals before reacting to news-driven pumps

📌 Final Outlook & 24-Hour Forecast

The current market structure across Bitcoin, Ethereum, and XRP shows one common theme — whales are aggressively positioned on the short side, and technical indicators confirm the bearish pressure.

🔮 What traders should watch next:

- Whale Pressure Meter reversal: Until BTC/ETH/XRP flip to Net Long on higher timeframes, rallies will likely be short-lived.

- RSI oversold zones: Oversold confirmation on 4H or 1D can create a temporary bounce.

- MACD crossovers: The next bullish crossover will be the first reliable early trend-reversal signal.

- Hyperliquid funding rates: If shorts become overcrowded, a short squeeze becomes highly probable.

⚠️ Disclaimer

This analysis is based on on-chain + technical indicator data and is for informational purposes only.

Crypto trading carries risk. Always DYOR.