Crypto momentum weakens across major assets as whale positioning continues to dominate market structure, limiting upside despite short-term bullish technical signals. Bitcoin and Ethereum are currently showing EMA and MACD alignment on lower timeframes, but this strength remains fragile under persistent whale-controlled conditions.

Rather than a broad-based recovery, the market is experiencing a controlled technical rebound driven by short covering and intraday momentum. Whale data shows that large players are maintaining defensive positioning, preferring risk management over aggressive accumulation. This imbalance is keeping price action compressed, increasing the likelihood of sideways movement and intermittent volatility spikes.

Across Bitcoin, Ethereum, and large-cap altcoins, the same pattern is emerging: bullish indicators on charts, but heavy whale pressure underneath. This divergence explains why rallies are failing to convert into sustained trends and why altcoins continue to underperform relative to Bitcoin.

In this report, we break down how whale behavior is shaping crypto market momentum, analyze BTC and ETH across 1H and 4H timeframes, and explain why the broader market remains structurally weak despite technical buy signals.

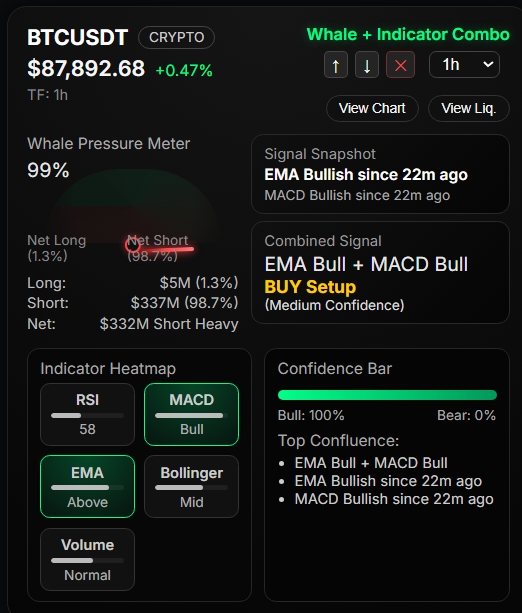

Bitcoin (BTCUSDT): Bullish Signals, But Whale Control Is Extreme

4H & 1H Technical Structure

- EMA: Bullish (price holding above EMA on both timeframes)

- MACD: Bullish crossover confirmed

- RSI: Neutral (51 on 4H, 55 on 1H)

- Volume: Normal, no breakout confirmation

- Combined Signal: BUY setup (Medium Confidence)

On the surface, Bitcoin shows clean short-term bullish alignment across indicators. Both 1H and 4H charts confirm momentum stabilization, suggesting buyers are active near the current range.

Whale Positioning: The Real Story

- Whale Pressure Meter: 99%

- Net Short: 98.7%

- Short Volume: $337M

- Long Volume: $5M

- Net Position: $332M Short Heavy

This is an extreme imbalance.

Bitcoin whale short pressure remains elevated

While indicators flip bullish, whales remain overwhelmingly positioned on the short side. This suggests:

- Whales are not closing shorts

- The current bounce is likely liquidity-driven, not accumulation-driven

- Any upside move risks being sold into by large players

📌 Key Insight (BTC):

Bitcoin is technically stable but structurally capped. Momentum exists, but it is controlled by short-heavy whale positioning, keeping price in a tight, vulnerable range.

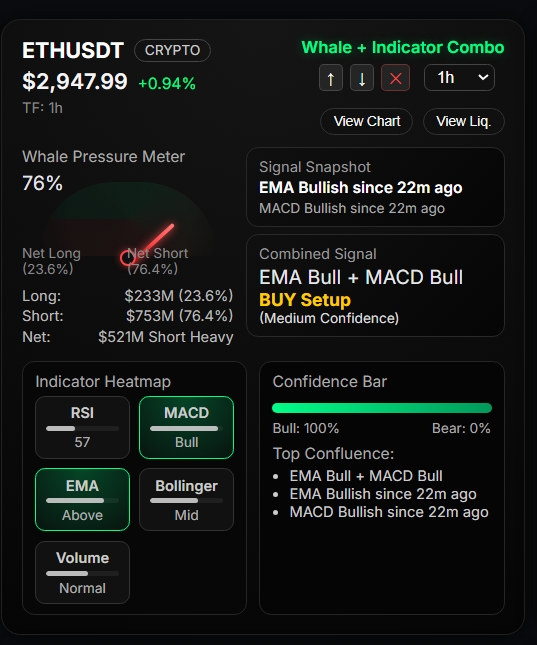

Ethereum (ETHUSDT): Stronger Technicals, Same Defensive Bias

4H & 1H Technical Structure

- EMA: Bullish on both timeframes

- MACD: Bullish crossover sustained

- RSI: Neutral (~50–55)

- Volume: Normal

- Combined Signal: BUY setup (Medium Confidence)

Ethereum mirrors Bitcoin’s structure — indicators show recovery, but without strong volume expansion.

Whale Positioning: Heavy and Persistent Shorts

- Whale Pressure Meter: 76%

- Net Short: 76.4%

- Short Volume: $754M

- Long Volume: $233M

- Net Position: $521M Short Heavy

ETH whales are less extreme than BTC, but still firmly defensive.

Ethereum price faces heavy whale short positioning

This positioning indicates:

- Whales are hedging against further downside

- Rallies are treated as selling opportunities

- No confirmation of long-term accumulation yet

📌 Key Insight (ETH):

Ethereum shows healthier technical alignment than Bitcoin, but whale behavior confirms risk-off positioning remains dominant.

Why This Is a “Momentum Weakening” Market

Even with bullish EMA and MACD signals:

- Whale capital is not aligned with price momentum

- Volume remains non-expansive

- Net positioning stays short-heavy across majors

This creates a market state where:

- Price can move up

- But follow-through is limited

- Breakouts lack structural support

Market-Wide Takeaway

- Short-term: Technical rebounds possible

- Medium-term: Sideways to capped upside

- Risk: Sharp downside if liquidity thins or sentiment shifts

📉 Alts remain vulnerable, as capital is concentrated in defensive BTC & ETH positioning rather than broad market risk-taking.

Final Verdict

Market Outlook: Defensive Until Proven Otherwise

Despite improving short-term technicals, the broader crypto market remains constrained by whale behavior. Bitcoin and Ethereum may continue to post short-lived bullish signals, but without a meaningful change in whale positioning, upside remains limited.

For traders, this environment favors range-based strategies over trend-following approaches. For longer-term participants, patience remains essential until whale exposure begins to unwind and volume confirms genuine accumulation.

In summary, crypto momentum weakens not because of failing indicators, but because structural control remains firmly in whale hands.