Published: December 15, 2025

The altcoin crash has intensified today as global risk sentiment deteriorates and heavy selling pressure sweeps across the crypto market. Major altcoins including Ethereum (ETH), XRP, Binance Coin (BNB), Solana (SOL), and Cardano (ADA) have all posted sharp intraday losses, pushing multiple technical indicators into oversold territory.

At the same time, whale positioning data reveals aggressive short exposure across most top altcoins, offering critical insight into what large market participants expect next. This report breaks down whale behavior, multi-timeframe indicators, and key confluences to assess what the current altcoin crash could mean in the near term.

This analysis is based on internal whale flow tracking and technical indicator aggregation and does not constitute financial advice.

Crypto Market Crash Context: Why Altcoins Are Under Heavy Pressure

Today’s sell-off is not isolated to a single asset. Across global markets, risk assets are facing renewed pressure due to tightening financial conditions, reduced liquidity, and heightened volatility. In crypto, this has translated into:

- Broad altcoin market weakness

- Elevated short positioning by whales

- Momentum indicators rolling over across higher timeframes

Historically, such conditions often lead to forced liquidations, sharp volatility spikes, and temporary price dislocations, especially in highly leveraged altcoins.

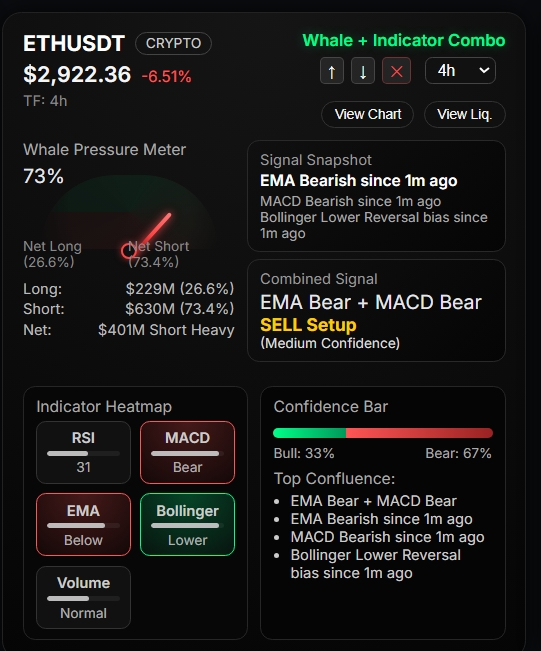

Ethereum (ETH) Whale Data and Indicators: Downtrend in Control

Ethereum has been one of the hardest-hit large-cap altcoins during this phase of the altcoin crash.

Ethereum Price and Whale Positioning

- ETH Price: $2,924.9 (−6.40%)

- Whale Pressure: 73% bearish

- Net Whale Position: ~$401M short-heavy

- Whale Bias: Bearish

Whales are overwhelmingly positioned on the short side, signaling low confidence in near-term upside.

Ethereum Technical Indicators (4H)

- EMA: Bearish (price below trend)

- MACD: Bearish momentum confirmed

- RSI: 32 (near oversold)

- Bollinger Bands: Lower band interaction

- Combined Signal: SELL (medium confidence)

Interpretation:

Ethereum remains technically weak despite approaching oversold levels. Until momentum stabilizes and whale short exposure reduces, ETH may continue to experience volatile downside or choppy consolidation.

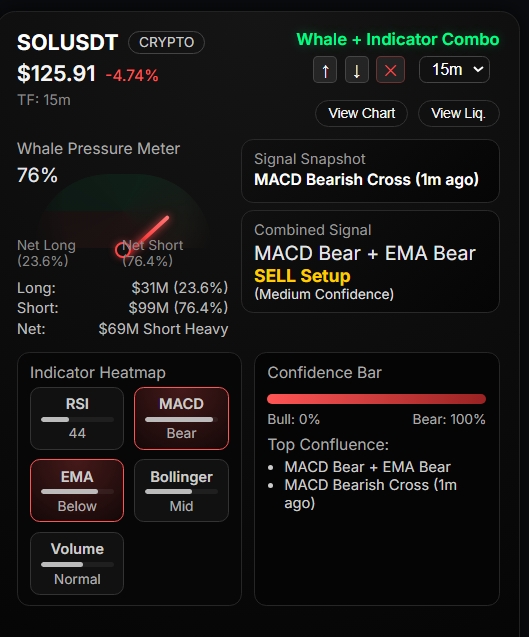

Solana (SOL): Strong Bearish Momentum Builds

Solana has also come under intense selling pressure during the altcoin crash.

Solana Whale Snapshot

- SOL Price: $125.87 (−4.77%)

- Whale Pressure: 76% bearish

- Net Whale Position: ~$69M short-heavy

SOL Technical Overview

- EMA: Bearish

- MACD: Bearish

- RSI: 37

- Combined Signal: SELL (medium confidence)

Interpretation:

Solana’s trend structure remains decisively bearish. Without a meaningful reduction in whale short exposure, upside attempts may face aggressive selling.

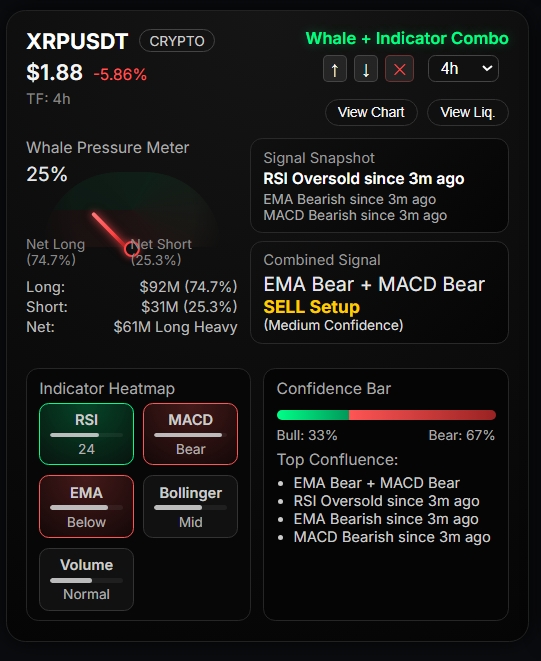

XRP: Oversold Conditions With Conflicting Whale Signals

XRP stands out slightly compared to other altcoins due to oversold momentum conditions.

XRP Whale and Indicator Data

- XRP Price: $1.88 (−5.85%)

- Whale Pressure: 25% bearish (long-heavy)

- Net Whale Position: ~$61M long-heavy

XRP Indicators (4H)

- RSI: 23 (deeply oversold)

- EMA: Bearish

- MACD: Bearish

- Combined Signal: SELL (medium confidence)

Interpretation:

Despite bearish trend indicators, XRP shows long-side whale accumulation during oversold conditions. This divergence often precedes relief rallies, though confirmation requires improving momentum.

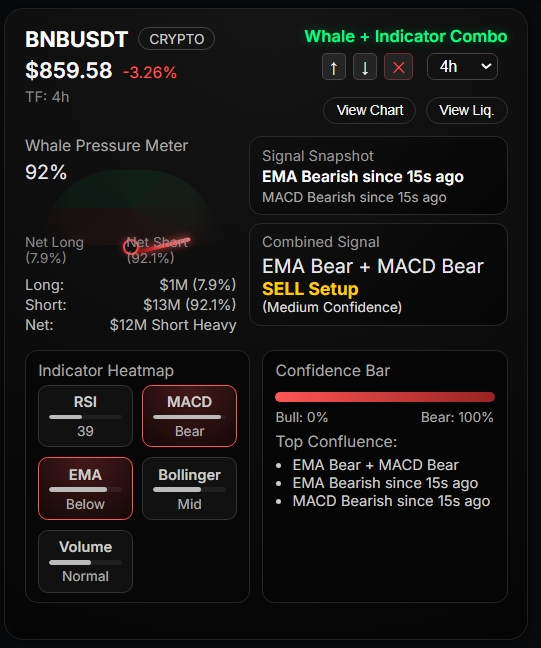

Binance Coin (BNB): Extreme Whale Bearishness

BNB displays some of the most aggressive whale short positioning among top altcoins.

BNB Snapshot

- BNB Price: $859.67 (−3.27%)

- Whale Pressure: 92% bearish

- Net Whale Position: ~$12M short-heavy

BNB Technicals

- EMA: Bearish

- MACD: Bearish

- RSI: 39

- Combined Signal: SELL (medium confidence)

Interpretation:

BNB’s structure suggests institutional caution. Extreme whale short dominance increases the risk of volatility spikes but does not yet signal trend reversal.

Cardano (ADA): Oversold but Still Weak

Cardano is showing oversold readings, but trend pressure remains intact.

ADA Whale Overview

- ADA Price: $0.38 (−5.35%)

- Whale Pressure: 78% bearish

- Net Whale Position: ~$2M short-heavy

ADA Indicators

- RSI: 27 (oversold)

- EMA: Bearish

- MACD: Bearish

- Combined Signal: SELL (medium confidence)

Interpretation:

ADA may experience short-term bounces, but broader trend conditions remain unfavorable without whale positioning shifts.

What This Altcoin Crash Suggests Next

Based on combined whale data and indicators across top altcoins:

- Whales remain defensively positioned

- Trend structure favors sellers

- Oversold conditions increase short-term volatility

- Relief rallies are possible but fragile

Historically, sustainable recoveries tend to occur after whale short exposure declines and momentum indicators stabilize across higher timeframes.

Key Takeaways for Global Crypto Traders

- The altcoin crash remains structurally intact

- Ethereum and Solana show strong bearish momentum

- XRP and ADA are oversold but not confirmed reversals

- Whale positioning continues to favor downside protection

Market participants should expect heightened volatility as the crypto market digests this phase of distribution.

Final Thoughts

The current altcoin crash highlights the importance of monitoring whale behavior alongside technical indicators. While oversold conditions often attract speculative interest, large players remain cautious — a signal that patience and risk management are critical in the current environment.

Disclaimer

This content is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile.

For live Ethereum price, market cap, and on-chain metrics, visit Ethereum on CoinMarketCap .For more crypto market insights and whale-driven analysis, visit Crypto News Page – Whale & Indicator Analysis .