Published on: December 15, 2025

Ethereum and XRP whale positioning today is drawing attention as the crypto market crashes globally, pushing both assets into deeply oversold indicator territory. Ethereum (ETH) and XRP have both posted steep intraday losses, pushing several technical indicators into deeply oversold territory. At the same time, whale positioning data reveals a striking divergence between ETH and XRP — a signal that often precedes sharp volatility.

In this report, we break down Ethereum and XRP whale positioning, multi-timeframe indicators, and what this combination suggests next as the crypto market digests its latest downturn.

This analysis is based on internal whale flow and technical indicator tracking and is not financial advice.

Crypto Market Crash Context: Why ETH and XRP Are Under Pressure

Today’s selloff is not isolated to a single asset. Across global markets, risk sentiment has deteriorated, with cryptocurrencies reacting sharply to broader uncertainty. As a result:

Understanding Ethereum and XRP Whale Positioning

- Ethereum has fallen over 4% intraday

- XRP has dropped around 4.5%, underperforming several large-cap peers

- Volatility has expanded across derivatives markets

Market-wide declines like this often reveal how large players are positioned, making whale data particularly valuable during periods of stress.

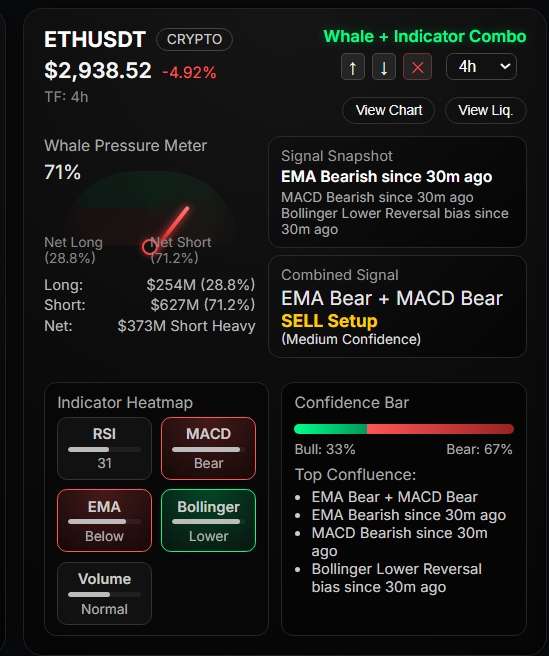

Ethereum Price Today: Heavy Whale Shorts Dominate

Ethereum is currently trading near $2,954, firmly lower on both short-term and higher-timeframe charts. Beneath the surface, whale positioning paints a decisively bearish picture.

Ethereum Whale Positioning Overview

- Whale Bias: Bearish

- Whale Shorts: ~87.5%

- Whale Longs: ~12.5%

- Total Whale Volume: ~$878M

- Net Whale Position: Short Heavy (~$376M net short)

This level of imbalance suggests that large traders are actively pressing downside exposure, not merely hedging.

Ethereum Indicators: Oversold but Still Weak

Despite the heavy selling, Ethereum’s indicators show clear signs of stress, not strength.

ETH 4H Timeframe

- EMA: Bearish

- MACD: Bearish

- RSI: ~32 (near oversold)

- Bollinger Bands: Lower band bias

- Combined Signal: SELL (Medium Confidence)

ETH 1H Timeframe

- RSI: ~22 (deeply oversold)

- EMA & MACD: Bearish

- Combined Signal: No strong setup (Low confidence)

This combination tells us something critical:

Ethereum is oversold, but structure remains bearish.

Oversold conditions alone do not guarantee a reversal — especially when whale pressure remains heavily skewed to shorts.

What Ethereum Whale Positioning Suggests Next

When whales remain aggressively short while indicators slip into oversold territory, two scenarios typically emerge:

Scenario 1: Continuation Lower

If price fails to stabilize:

- Oversold conditions can persist

- Whale shorts gain confidence

- Downside continuation accelerates

This is common during broader market selloffs.

Scenario 2: Short-Term Relief Bounce

If selling pressure eases:

- Oversold RSI triggers a technical bounce

- Shorts take partial profits

- Price rebounds briefly before meeting resistance

Given current data, any Ethereum bounce is more likely corrective than structural, unless whale exposure begins to unwind.

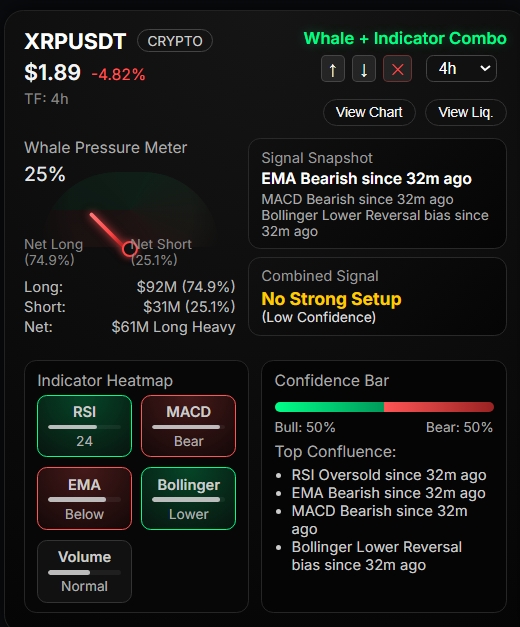

XRP Price Today: Oversold with a Very Different Whale Story

While XRP has suffered a similar percentage decline, its whale positioning tells a completely different story compared to Ethereum.

XRP is trading near $1.90, down roughly 4.5% on the day, but whale data shows net long exposure, not panic selling.

XRP Whale Positioning Overview

- Whale Bias: Bearish (headline), but positioning is mixed

- Whale Longs: ~74.9%

- Whale Shorts: ~25.1%

- Net Whale Position: Long Heavy (~$61M net long)

Despite the market downturn, large players appear to be accumulating XRP, not aggressively shorting it.

XRP Indicators: Extreme Oversold Conditions

Technically, XRP looks weaker than Ethereum on paper — but that weakness may already be priced in.

XRP 4H Timeframe

- RSI: ~24 (oversold)

- EMA & MACD: Bearish

- Bollinger Bands: Lower band reversal bias

- Combined Signal: No strong setup (Low confidence)

XRP 1H Timeframe

- RSI: ~15 (extremely oversold)

- EMA & MACD: Bearish

- Volume: Normal

This places XRP among the most oversold large-cap altcoins in the current market.

Why ETH and XRP Are Telling Different Stories

Here is the key takeaway that global traders should focus on:

- Ethereum:

- Whales are heavily short

- Indicators oversold but trend remains bearish

- Risk of continued downside remains elevated

- XRP:

- Whales are net long

- Indicators deeply oversold

- Selling pressure appears driven more by market panic than distribution

This divergence is crucial.

Historically, assets that are oversold with net whale accumulation often stabilize sooner than those experiencing active whale shorting.

What XRP Whale Positioning Suggests Next

For XRP, the risk-reward profile is different:

- Extreme oversold RSI increases probability of technical stabilization

- Net long whale positioning suggests confidence at lower levels

- Any broader market relief could disproportionately benefit XRP

However, it is important to note:

Oversold does not mean immune.

If the broader crypto market continues to slide, even accumulation-supported assets can remain under pressure.

Comparative Outlook: ETH vs XRP

| Factor | Ethereum (ETH) | XRP |

|---|---|---|

| Whale Bias | Strongly Bearish | Mixed / Net Long |

| RSI | Oversold | Extremely Oversold |

| Trend Structure | Bearish | Bearish |

| Risk Profile | Continuation Risk | Stabilization Potential |

This makes XRP more attractive for mean-reversion traders, while Ethereum remains vulnerable to further downside unless whale behavior shifts.

What This Means for Global Crypto Traders

In a market crash environment, the most important mistake traders make is assuming oversold equals bottom.

Key principles today:

- Respect whale positioning

- Use indicators for context, not prediction

- Expect volatility, not smooth reversals

Ethereum remains a trend-following market, while XRP currently behaves more like a capitulation-plus-accumulation setup.

Final Verdict: What Comes Next for ETH and XRP

As of today:

- Ethereum faces ongoing downside risk despite oversold conditions, as whale shorts dominate market structure.

- XRP shows signs of stress exhaustion, with whale accumulation contrasting sharply against price weakness.

The next meaningful move will depend less on indicators alone and more on how whales adjust exposure as market volatility unfolds.

For traders and analysts worldwide, this is a period to observe positioning changes closely, not rush decisions.

🔗 Research Note

This analysis is part of ongoing monitoring of whale positioning and indicator confluence across major crypto assets. Future updates will track how these dynamics evolve as market conditions change.

for more details analysis please follow our blog

Recommended External References

- CoinMarketCap (Price Data)

https://coinmarketcap.com

BTC currently trades near $89,000, confirming high intraday volatility. - TradingView (Trend Analysis)

https://tradingview.com