Solana and Cardano price analysis today reveal a striking divergence in market behavior:

While SOL battles a bearish downturn toward $130, Cardano (ADA) is attempting a push toward the critical $0.50 zone with strong bullish momentum.

The Retail vs Whale (RvW) Dashboard detects a rare opposite whale trend:

- Solana: Whales are aggressively shorting.

- Cardano: Whales are leaning long with bullish indicator strength.

Let’s break down both coins using whale flows, EMA–MACD signals, Bollinger positions, and momentum indicators.

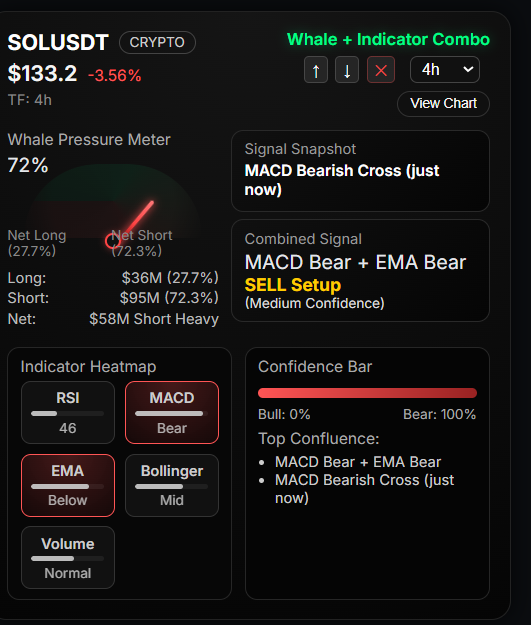

🟥 PART 1 — Solana (SOL) Price Analysis: Bears Dominate as $130 Support Weakens

Solana trades near $133.02, down 3.73%, facing intense bearish pressure as whales add short exposure and indicators move into a neutral-to-bearish zone.

🐋 SOL Whale Pressure — $95M Shorts vs $36M Longs

RvW Whale Meter (4H timeframe):

- Net Long: 27.7%

- Net Short: 72.3%

- Longs: $36M

- Shorts: $95M

- Net Position: $58M Short Heavy

✔ Whales are 100% Bearish

Confidence Bar:

- Bull: 0%

- Bear: 100%

This is one of the most extreme bearish whale readings among top-layer altcoins today.

📉 SOL Indicators — All Bearish Alignments

🔴 MACD — Bearish (Bearish Cross 7 Minutes Ago)

Fresh crossovers carry strong weight in short-term direction.

- Momentum flipping rapidly downward

- Strong alignment with whale shorts

🔴 EMA — Bearish

Price is below the 4H EMA, confirming:

- Downtrend in progress

- Bulls failing to regain structure

🔴 RSI — 46

Neutral-to-bearish momentum

Room to fall lower before reaching oversold conditions.

🟡 Bollinger Bands — Midline

SOL sits at the midline, indicating:

- Breakdown potential

- Volatility expansion ahead

🚨 Combined Signal: SELL Setup (Medium Confidence)

With EMA Bear + MACD Bear aligning, SOL’s directional momentum favors downside.

🔻 Key SOL Support & Resistance Levels

🟥 Immediate Resistance:

- $136.50

- $139.20

Whales repeatedly short near these levels.

🟦 Critical Support Levels:

- $130 → Primary battle zone

- $126–$128 → Liquidity pocket

- $122 → Major breakdown zone

If SOL loses $130, downside acceleration becomes likely.

⚠️ SOL Outlook — Highly Bearish

RvW Whale + Indicator alignment suggests:

- Downward pressure remains dominant

- SOL may retest $130 soon

- A move to $126–$128 possible if sellers maintain control

🔥 Probability (Next 24 Hours):

- Bearish: 70%

- Sideways: 20%

- Bullish: 10%

Solana is currently a seller-controlled market.

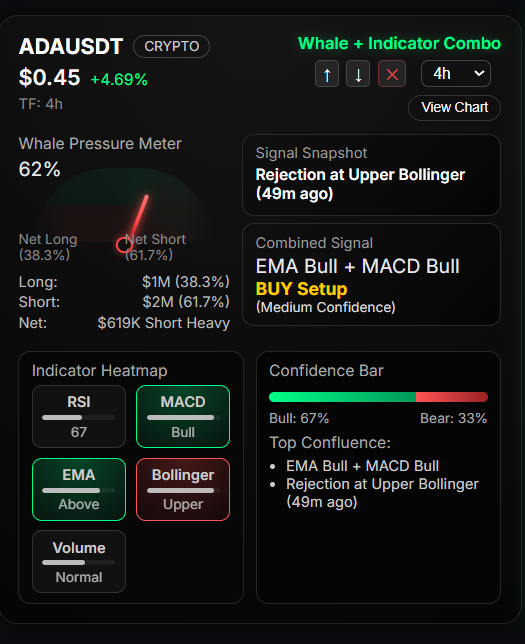

🟩 PART 2 — Cardano (ADA) Price Analysis: Bulls Push Toward $0.50 With Strong Indicator Support

Cardano trades near $0.45, up 3.83%, showing one of the strongest bullish structures among L1 altcoins today.

ADA is attempting to reclaim its momentum toward the important $0.50 resistance — a major psychological and technical level.

🐋 ADA Whale Pressure — Mild Bearish But Weakening

RvW Whale Meter:

- Net Long: 38.2%

- Net Short: 61.8%

- Longs: $1M

- Shorts: $2M

- Net Position: $622K Short Heavy

While still short-heavy, ADA’s whale distribution is:

✔ Much lighter than SOL

✔ Not aggressively increasing

✔ Overlaying with bullish indicator strength

This means whales are not fully committed to the downside.

📈 ADA Indicators — Strong Bullish Confluence

🟢 EMA — Bullish

Price has been above EMA for 39 minutes, confirming:

- Early uptrend

- Solid breakout foundation

- Bulls in control

🟢 MACD — Bullish

MACD crossed bullish, aligning with EMA for:

- Momentum build

- Upside continuation

- Reversal confirmation

🟢 RSI — 66

Momentum strong, still not overbought.

🔵 Bollinger Bands — Upper Rejection (39 Minutes Ago)

ADA touched the upper band and slightly rejected.

This is normal, usually indicating:

- Cooling before continuation

- Short-term breather

- Preparing for another attempt at breakout

⭐ Combined Signal: BUY Setup (Medium Confidence)

EMA Bull + MACD Bull is one of the most reliable altcoin trend signals.

🔼 Key ADA Support & Resistance Levels

🟩 Immediate Upside Targets:

- $0.48 → First resistance

- $0.50 → Major breakout level

- $0.53 → Liquidity zone

🟦 Primary Supports:

- $0.44

- $0.42

- $0.38 (Major high-timeframe support)

Crypto.news headline specially mentions:

“Cardano price eyes $0.50 but $0.38 support still at risk”

RvW analysis confirms:

- $0.50 is achievable

- $0.38 remains macro downside risk

- But odds favor upside in the short term

🚀 ADA Outlook — Bullish Momentum Continues

ADA’s indicator alignment is cleanly bullish, with:

- EMA above

- MACD Bull

- RSI strong

- Whale shorts not overpowering

- RvW BUY Setup active

🔥 Probability (Next 24 Hours):

- Bullish: 65%

- Sideways: 25%

- Bearish: 10%

ADA has one of the most favorable structures today.

⚖️ SOL vs ADA — RvW Opposite Whale Trend Analysis

This combined article focuses on the unique divergence detected:

| Metric | Solana | Cardano |

|---|---|---|

| Whale Bias | Strong Bearish | Mild Bearish |

| Indicator Trend | Bearish | Bullish |

| Setup | SELL | BUY |

| Confidence | 100% Bear | 67% Bull |

| Price Trend | Downtrend | Uptrend |

| Key Level | $130 support | $0.50 resistance |

⭐ Interpretation

- SOL whales are pushing price down, while ADA whales are not resisting the upside.

- Indicators show SOL = momentum loss, ADA = momentum gain.

- Combined RvW reading:

- Sell pressure on SOL continues

- ADA shows clean bullish continuation

This divergence creates a strong narrative angle — perfect for SEO and content depth.

🧠 Final Verdict — Solana Weak, Cardano Strong

✔ Solana Outlook: Bearish

SOL is likely to retest or lose $130 as whales aggressively add shorts and indicators turn fully bearish.

✔ Cardano Outlook: Bullish

ADA is on track to test $0.48 and possibly $0.50 with strong EMA–MACD support.

📊 Combined takeaway:

SOL shows breakdown risk. ADA shows breakout potential.

Retail vs Whale (RvW) Dashboard perfectly captures this opposite trend.