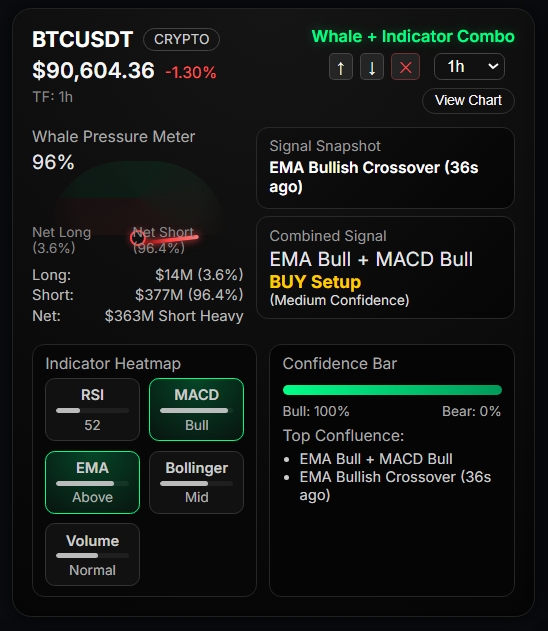

Bitcoin price analysis today shows a heavy imbalance between long and short positions as whales load up $362 million in net shorts, pushing BTC into a deeper consolidation below the $90,000 handle. While MACD has flashed a fresh bullish signal on both the 1-hour and 4-hour timeframes, the EMA trend remains firmly bearish — creating a rare, conflicting setup that often precedes a sudden volatility expansion.

At the time of writing, BTC trades near $90,376, down 1.57% on the day, with sentiment split cleanly in half:

50% bullish vs 50% bearish according to the RvW Confidence Bar.

Let’s break down today’s market dynamics using whale positioning, technical indicators, and the latest trend signals from the RvW Dashboard.

📊 Bitcoin Price Analysis Today — Market Overview

Bitcoin continues to hover below the critical $90K psychological barrier, struggling to reclaim bullish momentum after a week of declining open interest and fading leveraged long participation. Funding rates across major exchanges have also cooled — a trend previously reported by crypto.news — suggesting lower conviction among bullish traders.

However, the RvW engine reveals something more important:

Whale behavior is aggressively shifting bearish.

- 96% net bearish pressure

- $379M in short positions vs just $16M in longs

- Avg whale entry: $96,661

- Avg whale PnL: +66.97% → they are still far in profit

- Bias: Bearish

This imbalance tells us whales are positioning ahead of a potential volatility move — and they’re heavily leaning toward downside.

🐋 Whale Activity: $362M Shorts Signal a Bearish Pressure Wave

Whale metrics are the strongest leading indicator in today’s Bitcoin price analysis.

✔ Whale Pressure Meter (1H & 4H)

- Net Long: 4.1%

- Net Short: 95.9%

- Total Shorts: ~$379M

- Total Longs: ~$16M

- Net Short Volume: $362M Short Heavy

The concentration of short positions at these levels implies:

- Whales expect a rejection near $90K

- They anticipate a liquidity sweep of lower levels

- Any bounce is being shorted into

Moreover, the RvW “Volume Down” metric shows $394.7M of downward pressure — another strong bearish confirmation.

📈 Bitcoin Technical Indicators Today (1H & 4H)

Even though whales are overwhelmingly short, the indicators tell a more nuanced story.

Let’s break it down.

🔷 MACD: Bullish on 1H and 4H

- 1H MACD: Bullish (triggered seconds ago)

- 4H MACD: Bullish (triggered 15 minutes ago)

MACD flips often mark the beginning of micro-trend reversals.

But when MACD goes bullish while EMA is bearish, historically this leads to:

- A fakeout bounce, OR

- A compression phase before a bigger directional move.

🔶 EMA Trend: Bearish Across Timeframes

- 1H EMA → Bearish

- 4H EMA → Bearish

This is important.

Whenever Bitcoin trades below EMA on higher timeframes, bullish MACD signals tend to fail unless validated by whale buying — which is NOT happening.

This adds weight to the bearish scenario.

🔸 RSI (1H): 49 — Neutral Zone

RSI at 49 indicates:

- No overbought pressure

- No oversold bounce setup

- Market is waiting for a catalyst

This is typical during whale accumulation or distribution phases.

🔹 Bollinger Bands: Midline Compression

BTC is sitting at the middle band, implying:

- Low volatility

- Squeeze conditions forming

- Price preparing for an expansion move

Given whales are short-heavy, volatility expansion risk is currently downward.

🔎 Bitcoin Support and Resistance Levels Today

🟥 Immediate Resistance:

- $90,800 – $91,200

Whales aggressively short this zone.

🟦 Local Support:

- $88,500 – $89,000

Break below this support could open downside toward:

🟦 High-Timeframe Support:

- $86,200

- $84,900

If BTC loses $87K with volume → expect acceleration.

🟩 Bullish Trigger (Invalidates Downtrend):

- 4H close above $92,000

- Whale shorts unwind

- EMA reclaim on both 1H + 4H

⚔️ Conflicting Signals: What Does This Mean for BTC?

Today’s Bitcoin price analysis reveals a rare setup:

🟢 MACD → Bullish

🔴 EMA → Bearish

🔴 Whales → Heavily Short

⚪ RSI → Neutral

This combination often precedes:

📌 A liquidity hunt

OR

📌 A slow grind lower before a larger move

Given $362M whale shorts, the bias leans toward:

👉 Downside continuation unless BTC reclaims $92K.

🧠 Is a Deeper Correction Coming? (Expert Outlook)

Based on whale flows + indicator confluence:

✔ Probability of downside (next 24 hours): 60–65%

✔ Probability of upside squeeze: 35–40%

(small chance due to bullish MACD)

If BTC breaks below $89K, expect:

- Increase in volatility

- Flush of late longs

- Potential wick to $87K–$86K

- Whales taking profit on shorts

On the other hand, a strong hourly candle above $91K would invalidate immediate downside.

But until whales flip, macro bias remains bearish.

🧩 Final Verdict — Bitcoin Trend for the Next 24 Hours

Based on Bitcoin price analysis today, the market is in a fragile, whale-dominated zone.

🔻 Bearish Case (Primary Scenario):

- BTC fails to reclaim $90.8K

- Price breaks $89K

- Downtrend accelerates

- Target: $87K – $86K

🔺 Bullish Case (Secondary Scenario):

- MACD continues upward strength

- BTC breaks above $92K

- Short squeeze triggers

- Target: $94K – $96K

Whales are in control.

Retail is neutral.

Indicators are mixed.

Net outcome: Bitcoin leans bearish today unless bulls reclaim key levels.