By RvW Research Team — December 8, 2025

Bitcoin price analysis today shows BTC attempting a recovery after bouncing from the $87,000 liquidity pocket, briefly testing the $92,000 resistance before losing momentum. While the 4-hour chart signals early stabilization, the 1-hour timeframe has turned sharply bearish due to extreme whale short dominance, with more than $400M in short positions pressuring the market. This Bitcoin analysis highlights key levels to watch, including major resistance at $92K and downside risk around $89.8K, as short-term indicators point toward potential pullback conditions.

This combination creates a split market:

✔️ 4H showing early bullish momentum

❌ 1H showing strong bearish reversal signals

Let’s break down the data.

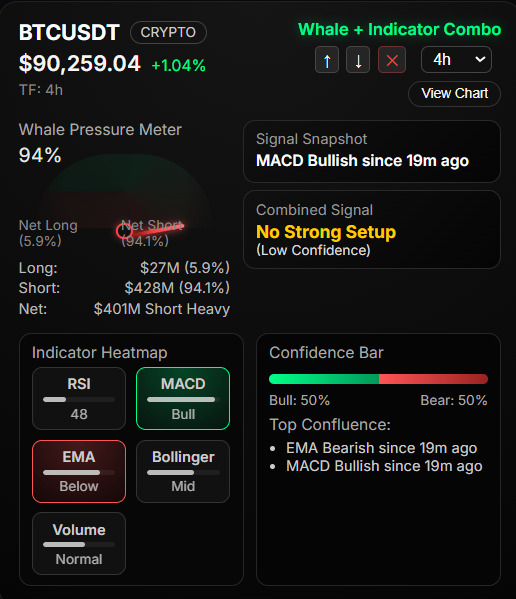

🐋 Whale Pressure Meter (4H): 94% — Still Short-Heavy

Despite BTC testing higher levels, whale behavior continues to dominate the short side:

- Net Long: 6.2%

- Net Short: 93.8%

- Long Value: $28M

- Short Value: $428M

- Net Difference: $400M short-heavy

What this means:

Whales are aggressively hedged against upside moves.

Even though price rebounded from $87K, this was not driven by strong buying, but rather a liquidity-driven bounce.

This explains why BTC failed to break $92K — whale shorts are suppressing upside momentum.

📈 4H Indicator Snapshot — Mixed Signals

MACD — Bullish (since 11 minutes ago)

Momentum is slowly turning positive after days of weakness.

But bullish strength is still weak.

RSI — 47 (Neutral)

Room for both upward and downward movement.

EMA — Price Below EMA Ribbon

Trend remains bearish until BTC closes above the 4H EMAs.

Bollinger Bands — Mid Zone

Price is compressing → volatility expansion likely soon.

Volume — Normal

No large accumulation from institutions yet.

4H Combined Signal: Neutral

MACD Bullish + EMA Bearish = No clean trend

This often happens during the early stage of a trend reversal — confirmation is still missing.

🔥 NEW 1H Technical Analysis — Market Turns Bearish Again

The 1-hour chart flips the entire narrative.

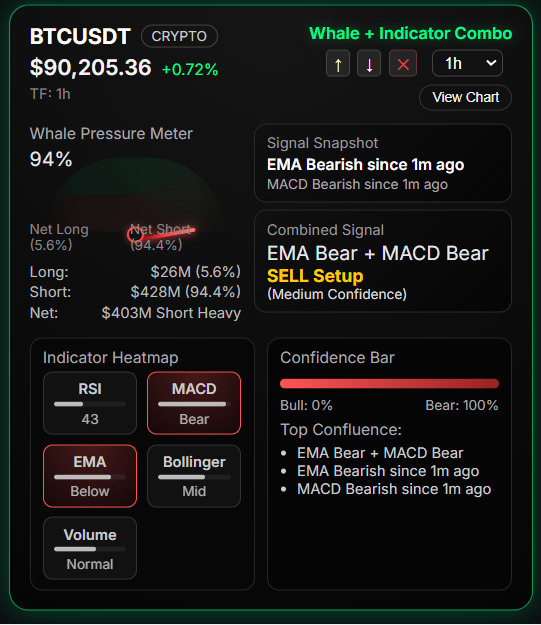

🐋 Whale Pressure Meter (1H): 94% Short Dominance

- Net Long: 5.7%

- Net Short: 94.3%

- Long Value: $26M

- Short Value: $428M

- Net Difference: $403M Short Heavy

Interpretation:

Whales are aggressively shorting the 1H timeframe.

Whenever whale pressure exceeds 90%, intraday pullbacks are extremely common.

🔻 1H Indicator Snapshot — Fully Bearish

EMA — Bearish (since 25 seconds ago)

Price has slipped back under the EMA ribbon → immediate weakness.

MACD — Bearish (since 25 seconds ago)

Momentum turned negative sharply after a failed breakout attempt.

RSI — 42

Not oversold yet → more room to fall.

Bollinger Bands — Mid Zone

Compression forming → volatility spike likely.

Volume — Normal

No signs of dip buying.

🔥 Combined 1H Signal: EMA Bear + MACD Bear → SELL Setup

Confidence: Medium

This confluence appears before 1–3% intraday dips, especially during whale-dominant short conditions.

Confidence Bar (1H)

- Bull: 0%

- Bear: 100%

There is zero bullish strength in the 1H chart right now.

📊 Multi-Timeframe Summary: 4H vs 1H

| Timeframe | Trend | Momentum | Whale Pressure | Signal |

|---|---|---|---|---|

| 4H | Bearish | Bullish MACD | Short-heavy | Mixed / Neutral |

| 1H | Bearish | Bearish MACD | Very short-heavy | SELL |

Interpretation:

The 1H chart overrides the 4H weak bullish momentum.

Unless BTC quickly breaks and holds above $92K, the short-term outlook is bearish.

🧭 Updated Key Levels With 1H Influence

🔼 Upside Resistance

- $92,000 — Must reclaim to flip short-term bullish

- $94,500 — Whale liquidity pocket

- $97,200 — Pre-breakout resistance

- $100,000 — Psychological barrier

A breakout above $92K would invalidate the 1H bearish bias.

🔽 Downside Support

- $89,800 – $90,200 → At high risk of breaking

- $87,500 – $88,300 → Whale re-accumulation zone

- $85,900 → Major structural support

Given the 1H reversal and whale shorts, BTC is more likely to revisit $89.8K, and if weakness persists, dip toward $88K.

🎯 Final Outlook — Neutral to Bearish

- 4H shows early recovery signs ⚡

- 1H turned strongly bearish again 🔻

- Whales hold over $400M in shorts across both timeframes

- Momentum is weakening below $92K resistance

Conclusion:

BTC needs a strong breakout above $92,000 to regain bullish structure.

Until then, intraday pullbacks toward $89.8K–$88K remain the most likely scenario.